I was seeking a platform to level up my finance skills, and that’s when I came across the Corporate Finance Institute (CFI). I decided to enroll in their FMVA program and a few other courses to check if this platform is worth pursuing.

After completing the courses, I not only gained practical modeling skills but also received job offers from top firms. The real-world templates and hands-on case studies made all the difference.

In this review, I’ll walk you through my complete experience with CFI; covering their certifications, pricing, what worked well, what didn’t, and whether it’s worth your money in 2025.

Corporate Finance Institute Review 2025 – Quick Verdict

CFI provides accredited certificates and credits to its learners. The online courses are mainly designed for individuals and training larger organizational teams. It offers online programs specifically for –

- Financial planning and analysis

- Financial modeling

- Investment banking

- Credit analysis

- Capital markets

- Data analytics

- Fintech

Get 40% OFF on CFI

Save 40% Off on CFI plans by clicking on the coupon link.

Is Corporate Finance Institute Legit- Certificates And Other Recognitions

CFI is associated with and recognized by 20 global bodies related to finance, including some government-affiliated organizations. When a government body or a national association trusts a platform like the Corporate Training Institute (CFI), it speaks volumes about its legitimacy and recognition.

A few other things and noteworthy associations that make CFI legit are-

1. Recognized by The CPA institute

The Certified Public Accountants (CPA) Institute requires accountants to earn credits to qualify. You can earn these CPE credits on CFI. CFI is accredited by the CPA Institutions.

2. CPE Credits For CPA Members In America

Learners can earn CPE Credits per Course when they complete particular courses on CFI. The CFI’s CPE Program can help you earn 254.5 CPE credits. The complete list of programs and breakdown of the credits can be found here.

3. CPD Credits For CPA Members In Canada, The UK, And Australia

Continuing Professional Development (CPD) is a requirement of CPA for CPAs in Canada, the UK, and Australia. These credits can be earned on CFI. Find out how to calculate them here.

4. NASBA’s Association With CFI

The National Association of State Boards of Accountancy( NASBA), which has a presence in 50 states, receives training from CFI for the Financial Modeling and Valuation Analyst (FMVA)™.

5. BBB Association With CFI

CFI is accredited by the Better Business Bureau® (BBB) to maintain training standards. Better Business Bureau® (BBB) also trusts the Corporate Training Institute to train its employees with the Financial Modeling & Valuation Analyst (FMVA)™ certification program.

Corporate Finance Institute Review- Pros & Cons

Now that you know how well-recognized and legit the CFI platform is and are considering signing up, you must learn its pros and cons.

Pros

- Bite-sized lessons

- Structured course plan

- Practical exercises

- Intuitive platform and course design

- Life-long access to learning material

- Improves essential Excel and PowerPoint skills

Cons

- The final exam is more difficult than the practice exam

- It can be expensive for students

- Meant for self-motivated learners

- No mobile app

How Reliable Is Corporate Finance Institute?- My experience With CFI

CFI is highly reliable regarding the quality of the course and knowledgeable tutors. CFI is trusted due to its accreditation from-

I will share my experience using the Corporate Finance Institute’s learning platform on various factors. Use this review of factors to understand precisely what the CFI platform is like and whether you want a paid subscription.

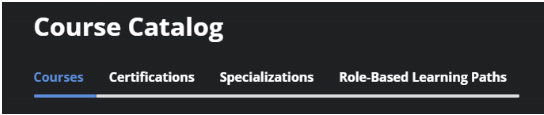

Courses By Corporate Finance Institute

214 courses are available on the Corporate Finance Institute (CFI) platform(discussed in detail in the review later). The courses on CFI can be differentiated into two types:

- Certifications

- Specializations.

The difficulty of the courses is given in levels, and courses on the platform range from level 1 (for novices) to level 5 (for experts).

On average, courses on CFI took me 4 to 5 months to complete. The issue with such a comprehensive course is that you must be self-motivated to revise what you learned earlier. Otherwise, you will easily forget what you learned in the course in the first few months.

Instructors By Corporate Finance Institute

CFI takes pride in its association with top industry experts from various industries and fields who design each course for learners like you and me. One of these experts typically introduces a particular course on CFI.

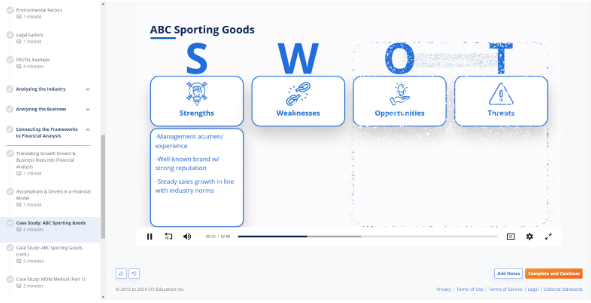

CFI instructors appear in courses in a pre-recorded video only at the beginning of the class. The courses are then further taught using animated graphics and recorded instructions, as shown in the image below.

The instructor’s voice is easy on the ears, and if you can not understand their accent, you also have the option to slow the speed of the video or turn on the closed captions.

Peer Community & Networking On Corporate Finance Institute

Once you pay for a CFI membership, you will get access to the exclusive members-only LinkedIn group. This group provides insider news about industry-related events and beneficial tips and knowledge.

In my opinion, the exclusive group is the real star because it helps you solve your doubts, meet like-minded people, and network with people in your industry from around the world.

Opportunities are abundant for you to interact directly with your course makers in the group, and everything is replied to promptly. I resolved most of my course problems and queries in this group, as the members were incredibly active and helpful.

User Interface And User Experience Of Corporate Finance Institute

Using CFI’s learning platform is intuitive and easy. The course flow is well structured, going from lesson to quiz to lesson to assessment and so on as and when needed, so you do not have to spend time figuring out what to do next.

You can also change the mode or theme on CFI. Since I took the course mainly in the evening after work, I preferred the dark theme, which was not too bright for my eyes. If you are a fan of light-colored themes, you can press the crescent moon sign pointed out in the image above to change them.

Another thing worth mentioning about CFI is how interactive the courses have been. My experience as a user of CFI has been great, so I give their design, UI, and UX team a big thumbs up!

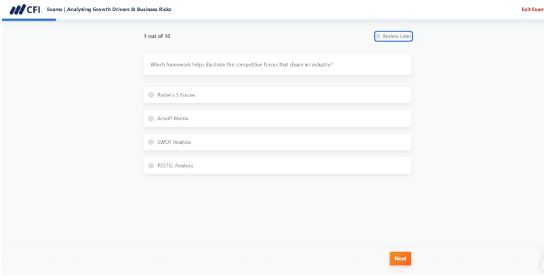

Exams And Assessments On Corporate Finance Institute

The exam and study material are only available with a subscription to CFI. The certification exams on CIF are difficult to pass, as the passing criteria are 70%-80 %.

The certification courses have a final exam, but this is not the case with the specializations in CFI. The specialization courses on CFI do not have a big final exam like the certification courses; learners simply get a course completion certificate upon completing a specialization.

I recommend you take the quizzes and assessments given to you in the middle or end of each chapter seriously. Since the courses are lengthy, I recommend revising them for the final exam, as it is not as straightforward as the preliminary quizzes.

The good news is that you can retake exams on CFI’s platform as often as you have a platform subscription. You will only have to wait 30 days to lapse between attempts.

Scholarship And Financial Aid On Corporate Finance Institute Review

The CFI scholarship program is currently inactive and will not be open for this year. CFI usually gives a $500 scholarship to needy students with promising talent.

Check the list of students who have received the scholarship here.

As I type this, financial aid is also currently unavailable on CFI. But if it becomes available soon, let me share some essential pointers from my experience that will benefit you.

Eligibility criteria for financial aid on CFI:

- Complete all the free courses related to the topic for which you want financial aid.

- Then, fill out and submit the financial aid form. If selected, you will receive the acceptance letter via email.

- Financial aid cannot be used to rebate a program you have already bought.

- Only the “Self-Study” Subscription is given in financial aid.

Pricing- Corporate Finance Institute

A CFI subscription is available for individual, students, and team training. The table below shows the cost of a Corporate Financial Institute (CFI) subscription and what is included in each plan.

If you wish to purchase the course subscription for your team at work, refer to this link.

For Individuals and Students

| Plan Features | Individual Course | Self-Study | Full-Immersion |

|---|---|---|---|

| Regular Price | $297 to $497 | $497/year | $847/year |

| Current Price (30% OFF) | No Discount | $347.90/year | $592.90/year |

| Student Price (50% OFF) | Not Available | $248.50/year | $423.50/year |

| Free Trial | ❌ | ❌ | ❌ |

| Refund Policy | ❌ | ❌ (EU only) | ❌ (EU only) |

| Course Access | 1 course only | 200+ courses | 200+ courses |

| Quizzes & Case Studies | Limited Access | ✅ Full Access | ✅ Full Access |

| CPE/CPD Credits | ❌ | ✅ (550+ credits) | ✅ (550+ credits) |

| Certifications | 1 per course | Unlimited | Unlimited |

| Accredited Certifications | ❌ | ✅ | ✅ |

| Community Access | ✅ | ✅ | ✅ |

| AI Resume Builder | ❌ | ❌ | ✅ |

| 1-on-1 Expert Guidance | ❌ | ❌ | ✅ |

| Financial Model Review | ❌ | ❌ | ✅ |

| Best For | Single skill upgrade | Self-paced learners | Professionals |

For Teams

Organizations looking to train multiple employees can access CFI’s team plans. These corporate packages include admin tools, reporting features, and volume pricing. Here’s what each team plan offers:

| Plan Type | Basic | Premium |

|---|---|---|

| Price per Learner | $399/year | $497/year |

| Minimum Learners | 2 | 2 |

| Course Access | 250+ courses | 250+ courses |

| Certifications | Limited | Full certification exams |

| Learning Paths | Role-based paths | Role-based paths |

| Admin Dashboard | ✅ | ✅ |

| Reporting Tools | ✅ | ✅ |

| Digital Certificates | ✅ | Blockchain-verified |

| Best For | Small teams | Organizations needing certifications |

Refund Policy Of Corporate Finance Institute (CFI)

No refund is available on CFI, so be aware of this when you buy the subscription. Ensure you unsubscribe when you receive your certificates, as not canceling your membership can lead to auto-renewal, where you will be charged for an additional year and will not have a refund option.

However, the refund is only available to European Union citizens, as per the rules and regulations of European nations.

CFI Discounts

The Corporate Finance Institute (CFI) is offering a 40% discount on its “Self-Study” and “Full Immersion” plans. Here are the details in a tabular format.

You can claim a 40% discount on CFI here!

Get 40% OFF on CFI

| Plans | Original Price | Price after Discount | Savings |

|---|---|---|---|

| Self-Study | $497 | $347.90 | ~$150 |

| Full immersion | $847 | $592.90 | ~$254 |

Famous Courses On Corporate Finance Institute (CFI)

CFI is known for its certification courses and specializations. The platform offers 28 free courses and learning paths tailored to specific careers, in addition to its renowned offerings.

I have also covered my top picks to help you choose the best CFI courses separately.

The primary courses offered by CFI are as follows-

1. Corporate Finance Institute (CFI)- Certificate Courses

Six certificate courses on CFI are in demand by individual learners and private and government-affiliated organizations. Let me help you with their details by reviewing each one.

These certificate courses start from $497/ year on CFI; learners can choose or skip the introductory chapters, which is an excellent option for professionals who are well-versed in the basic terminologies related to that field.

However, the “Core course” is compulsory, followed by an “Elective course” where learners can choose a few electives to master more advanced topics.

1. Financial Modeling & Valuation Analyst (FMVA)®

The FMVA course is a comprehensive program designed for individuals seeking to deepen their financial knowledge. This course truly is bridging the gap between work and higher education. Let us see how.

| FMVA® Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Optional Chapters | 9 |

| Core Courses | 14 |

| Electives | 3 or more |

| Careers in FMVA | Equity Research, Corporate Development, Private Equity, Financial Planning & Analysis, Investment Banking |

| Learning Objectives | Accounting, Excel, Finance, Financial Modeling, Valuation, Budgeting & Forecasting, Presentation & Visuals, Strategy |

| Course Link | Click Here |

To earn a certificate, you must take a final exam by the end of this series. The passing grade for the FMVA exam is 70%. You will receive a blockchain digital certificate with your new credentials if you successfully pass.

2. Business Intelligence & Data Analyst (BIDA®) Certification

This course is highly recommended for anyone starting or upgrading their knowledge in data science. You will learn relevant business intelligence tools and programming languages step by step.

The best part about BIDA certifications is that you can earn certificates for each tool you learn in this course separately.

| BIDA® Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Optional Chapters | 3 |

| Core Courses | 14 |

| Electives | 3 or more |

| Careers in BIDA | Data Analyst, Business Analyst, Quantitative Analyst / Data Scientist, BI Developer, Data Visualization Analyst |

| Learning Objectives | Data Transformation & Automation, Data Visualization, Data Modeling, Coding, Predictive Analysis, Statistics |

| Course Link | Click Here |

If you pass with 70% in each course assessment, you will take the final BIDA exam focused on BI and data analysis and earn the program certification.

3. Financial Planning & Wealth Management (FPWM™) Certification

FPWM™ focuses on theory and soft skills to bring you the knowledge you need to deal with your clients. This course is great even if you are not looking forward to making a career as a finance advisor/ planner.

Note– I will cherish the FPWM™ course, which helped me better plan my finances.

| FPWM™ Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Optional Chapters | 8 |

| Core Courses | 12 |

| Electives | 4 |

| Careers in FPWM | Investment Advisor, Private Banker, Financial Planner, Portfolio Manager, Retail |

| Learning Objectives | Financial Planning, Practice Management, Business Development, Relationship Management, Investment Management |

| Course Link | Click Here |

You will receive the certificate after completing all the course material, assessments, and quizzes and passing the final exam with 70% or more.

4. Commercial Banking & Credit Analyst (CBCA®) Certification

Commercial Banking & Credit Analyst (CBCA®) is meant for learners who want in-depth knowledge of Credit analysis or an understanding of finance. Here are its details-

| CBCA® Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Optional Chapters | 12 |

| Core Courses | 16 |

| Electives | 3 or more |

| Careers in CBCA | Risk Manager & Credit Adjudicator, Commercial Loan Broker, Private Lender, Credit Analyst, Commercial Loan Officer |

| Learning Objectives | Financial Analysis, Credit Structure & Documentation, Management & Business Analysis, Risk Management, Industry Analysis |

| Course Link | Click Here |

The passing criteria, like all the above certificate courses, are the same (70%) for CBCA®.

This course has an optional case study challenge, which I recommend learners take. This case study will help you learn real-life tools that will be useful in day-to-day life, whether at work or at home.

5. Capital Markets & Securities Analyst (CMSA®) Certification

This course will teach you standard management and business concepts, along with the essential knowledge required for successful careers in capital markets, both on the buy-side and sell-side.

| CMSA® Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Chapters | 7 |

| Core Courses | 8 |

| Electives | 7 |

| Careers in CMSA | Asset Management, Wealth Management, Risk Management, Origination, Research, Treasury, Sales and Trading |

| Learning Objectives | Derivatives, Fixed Income, Analytical Methodologies, Foreign Exchange, Commodities, Equity |

| Course Link | Click Here |

The CMSA® also consists of case study challenges, which help you apply your knowledge and skills by solving real-world problems. The final exam is the standard 70% passing criteria exam, which earns you the CMSA® program certificate.

6. FinTech Industry Professional (FTIP™) Certification

The fintech industry is booming. Take this newly added course on CFI and join this novel field by learning skills and knowledge in InsurTech, WealthTech, digital banking, cryptocurrencies, payment technology, RegTech, data science, and financial analysis.

| FTIP™ Rating | ⭐⭐⭐⭐⭐(4.9 out of 5) |

| Introductory Optional Chapters | 5 |

| Core Courses | 11 |

| Electives | 4 |

| Careers in FTIP | Data Analyst, FinTech Strategist/Consultant, Analyst/Specialist, Software Developer |

| Learning Objectives | Financial Technology Fundamentals, Data Science and Machine Learning, Cryptocurrencies and Blockchain |

| Course Link | Click Here |

There are 23 total courses in the FTIP™ program, of which you will have to complete 14 required ones to qualify to take the exam. This program also has an option for case study challenges, and the passing grade to earn the certificate remains the same as the rest of the certificate programs(70%).

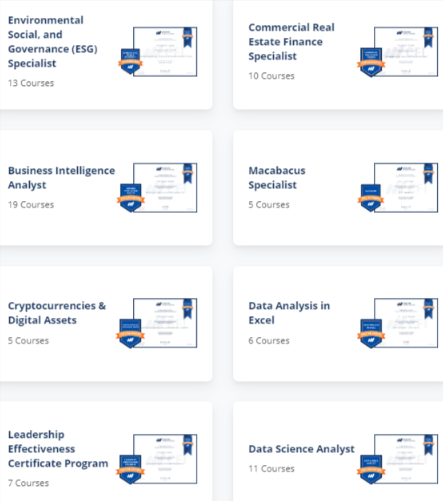

2. Corporate Finance Institute (CFI)- Specialization

CFI has nine specializations, as shown in the image below. These specialization courses differ from certificate courses because they do not have a final exam. The courses also have fewer chapters than the certified programs on the platform.

Specialization courses are ideal for acquiring knowledge and skills in incredibly narrow niches. I recommend specialization courses for professionals or advanced-level learning, as some prior knowledge about the topic is necessary to build on it.

A few highly rated Specializations in the Corporate Finance Institute are-

1. ESG Certificate Program

This course will polish your knowledge of finance, reporting, investing, and business strategy. In the lab session, you will also practice conducting a materiality assessment, developing ESG policies, and developing an ESG governance structure.

| Total Courses | 13 |

| Required Courses | 10 |

| Practice Lab Courses | 3 |

| Time Taken | 30 to 35 hours |

| Useful for | Asset Management, Management Consulting, Business Analyst, Credit Analyst, Corporate Development, Senior Leadership |

| Course Link | Click Here |

2. Macabacus Specialist

Learn the Microsoft add-on Macabacus to use automation techniques to create error-free and more professional financial models and presentations effortlessly.

| Total Courses | 5 |

| Required Courses | 5 |

| Practice Lab Courses | ❌ |

| Time Taken | 10 to 12 hours |

| Useful for | Investment Banking, Private Equity, Valuation, Financial Planning & Analysis, Equity Research |

| Course Link | Click Here |

3. Commercial Real Estate Finance Specialist Program

This course will teach you about the differences in sale and construction timelines, maximum land loans, and waterfall equity appraisals, as well as financial models and mortgages. It comprises 10 chapters, each accompanied by a mortgage case study, to provide you with practical knowledge.

| Total Courses | 10 |

| Required Courses | 10 |

| Practice Lab Courses | ❌ |

| Time Taken | 40 to 50 hours |

| Useful for | Commercial Relationship Managers, Credit Analysts, Risk Managers & Credit Adjudicator, Commercial Mortgage Brokers, Private Real Estate Lenders, Real Estate Investors, and Advisors |

| Course Link | Click Here |

3. Corporate Finance Institute (CFI)- Free Courses

You can take all the available free CFI courses by signing up on the platform. The best thing is that you can get CPE credits and a free digital blockchain certificate upon completing a free course. Along with the free courses, CFI also offers free downloadable templates for you to use in your personal and work life.

A few free courses offered by CFI are as follows-

1. Fundamentals Of Credit

The Fundamentals of Credit is a beginner-friendly course that uses easy-to-understand language to explain basic credit-related concepts.

| Level | 1 |

| CPE credits | 2 |

| Part of | CBCA® |

| Learning Objectives | Basics of credit, credit structure, and framework, types of interest payments, and loan |

| Course Link | Basics of credit, credit structure and framework, types of interest payments, and loan |

2. Introduction To Banking

This course taught me the most important thing we should have been taught in school- banking. It is an excellent course that will teach you the inner workings of a bank and how a bank makes money.

| Level | 1 |

| CPE credits | 2 |

| Part of | CBCA® |

| Learning Objectives | Learn different types/structures of financial services firms and banking services |

| Course Link | Click Here |

3. Data Science & Machine Learning Fundamentals

The course will start by defining the skills, tools, and roles behind data science and gradually move into the finer details of machine learning. By the end of the course, you will have a fundamental understanding of how to use data science outputs in business.

| Level | 2 |

| CPE credits | 3.5 |

| Part of | FTIP™ |

| Learning Objectives | Qualified assessment, data science basics, regression, classification, data preparation, other types of analysis |

| Course Link | Click Here |

4. Famous Corporate Finance Institute (CFI)- Learning Paths

Learning paths are tailored courses and practical exercises for learners to build a career in a specific job. CFI offers more than 20 learning paths with various roles. The learning paths are available in the following career areas-

- Sell-Side Banks

- Buy-Side Institutions

- Financial Planning & Analysis

- Wealth Management

Alternatives To Corporate Finance Institute (CFI)

If you are looking for similar but less expensive options or those that offer a different teaching style, consider the following alternatives.

| Parameter | CFI | Wall Street Prep | Luna Course | Financial Edge |

|---|---|---|---|---|

| Starting Price | $347.90 | $199 | $9 | $549 |

| Rating | 4.4 out of 5 | 3.0 out of 5 | 4.1 out of 5 | 4.3 out of 5 |

| Free Trial | ❌ | ❌ | ❌ | ❌ |

| Accredited Certificates | ✅ | ❌ | ❌ | ✅ |

| CPE Credits | ✅ | ✅ | ❌ | ✅ |

| No. of Courses | 214 | 46 | 3545 | 3,000+ |

| Best For | Difficult topics in finance and accounting | Financial modeling, investment banking, and related fields | Affordable, Group Buying | Courses from financial modeling to valuation. |

1. Wall Street Prep

Wall Street Prep has one of the best financial modeling certifications. Wall Street Journal courses are popular in organizations like investment banks, private equity firms, and business school programs to train analysts and associates.

Like CFI, they offer self-study courses designed by industry experts. At an additional cost, individual learners can also opt for boot camps and 1:1 instructor classes. They also provide guidance and review for interview preparation.

This is an excellent alternative to CFI, designed for professionals and students to learn Excel, financial statement modeling, valuation, mergers and acquisitions (M&A), and leveraged buyouts (LBO) modeling, among other topics.

2. Luna Course

Luna Course is the most affordable alternative to CFI, with courses starting at just $9. Luna Course offers various courses on topics such as Business and marketing, Forex and trading, NLP and hypnosis, Health and fitness, and Love and seduction.

If your budget concerns you, using Luna Courses is a sensible option, as this site operates on a group-buying model. For example, if a course costs $1,000, it will be bought through “Group Buying,” and each group member will pay $100 (10% of the $1,000).

Luna Course offers a variety of courses from renowned course authors. Learners buy a course bundle, pay for it, and wait for the course material to be emailed to them. This, by default, enables learners to make a one-time purchase of a course and gain lifetime access to it.

3. Financial Edge

Financial Edge offers training programs to well-known organizations like J.P. Morgan, Goldman Sachs, and Barclays on topics like investment banking fundamentals to specialized PE and asset management.

They have 9 full-time instructors whose collective experience totals 157 years in the banking and finance industry. Financial Edge has created a dedicated online learning product called Felix’, a toolkit for finance enthusiasts.

Felix’ on the Financial Edge online learning platform offers Micro-degrees and online courses, exclusive live webinars, live expert support, company tearsheets, and filings

market and industry data, sector, and transaction models.

User Testimonial And Ratings – Corporate Finance Institute Review

While researching the Corporate Finance Institute, I stumbled upon a few testimonials that I related to. Here they are for your reference-

Their courses cover every practical detail of finance concepts!”

Valuable information in an easy to undestand style.”

Is The Corporate Finance Institute (CFI) Worth It?

Corporate Finance Institute is worth your time and money because it is widely used by learners worldwide to earn accredited certificates to help them excel professionally.

The certificates you earn on CFI show that you are dedicated, motivated, and have been trained to perform job-ready skills, making you a preferred candidate for hiring or promotion.

Although this is my experience, other users have also reported positive feedback after taking the courses.

And with a 40% discount, you can access amazing CFI courses at a cheaper price than others. Try today!

Get 40% OFF on CFI

Final Verdict- Corporate Finance Institute Is Worth Your Investment And Time

After spending months on CFI, I can honestly say it’s worth the investment if you’re serious about building finance skills. Also, at $347.90 for the year on the individual plan, it’s far cheaper than most finance courses out there.

Plus, student get discounts of 50% off, which is more affordable than I expected. FMVA stands out as their strongest offering, but their other certifications FPAP and BIDA are are also worth pursuing.

f you’re willing to study on your own schedule and want practical skills fast, go for it. However, remember that CFI courses won’t replace your degree, but it’ll definitely give you an edge in interviews and at work.

Feel free to drop your queries and questions in the comment section below!

FAQs

2 Million+ Professionals and Leading Organizations trust CFI for training purposes. It is also accredited by the Certified Public Accountants (CPA), BBB (Better Business Bureau®), and NASBA, making it a credible source.

CFI (Corporate Finance Institute) is slightly more expensive than WSP (Wall Street Prep). WSP’s financial modeling certification is the best, whereas CFI’s best course is its Financial Modeling & Valuation Analyst (FMVA)® certification course.

CFI is recognized in the USA by government agencies like the Certified Public Accountants (CPA) Institute and other organizations like BBB (Better Business Bureau®).

FMVA and CFA courses are good for different reasons. FMVA is a course that teaches financial modeling and valuation. CFA is a prestigious title that is highly regarded in the finance industry, and it will help you move forward in your career and organization.

The CFA Institute offers the professional designation of Chartered Financial Analyst (CFA). Corporate Finance Institute is a learning platform on which industry experts offer courses and certificates that may earn learners some CPE/CPD credits.